About the Budget Deficit

In Leander ISD, early projections for 2022–23 showed a budget deficit of about $35 million and a deficit that increases by more than $10 million annually in the following years. Due to these projections, the district started looking at ways to decrease expenditures and increase revenues.

With the implementation of HB3 (2019) and the COVID-19 pandemic (2020), district revenue has not been growing at the same rate as expenditures. HB3 introduced a cap to an increase of funds generated by the M&O rate year over year.

Expenditures are growing – things like teacher pay raises, hiring additional teachers, new programs, department budget increases, with inflation having an impact in nearly every area – by $17 million per year. However, projected revenues only increase by $9 million per year.

A solution to the current budget deficit will require the district to both look for ways to decrease expenditures while also increasing revenues.

Current Budget Outlook

Changes to school finance as a result of House Bill 3 have created a reality for Leander ISD where the money coming into the district is not rising at a fast enough rate to keep up with the increased amount of money going out of the district. This budget deficit results in the district dipping into fund balance – similar to a rainy day fund – to make the budget whole.

Before House Bill 3, the district had a history of adopting a deficit budget and then at the end of the year, when everything was said and done, it would turn out to be a surplus that increased the fund balance. That was because the district would budget revenues very conservatively, property values would increase, and the district would have excess tax collections. Those factors, combined with budgets traditionally not being spent in full, have historically turned budget deficits into budget surpluses by the end of the fiscal year.

However, as the district looks forward, HB3 – combined with other factors, such as COVID-19 and inflation – has created an environment where revenues are not keeping pace with expenditures, and those traditional budget deficits are not expected to turn into a surplus by the end of the year.

Addressing the Deficit

Leander ISD will look to both enhance revenues and cut expenditures to continue offering the great experiences and programs we offer students in the district.

Cutting Where We Can

The preparation of an annual budget is an ongoing process that changes as new information is received. As the 2022–23 budget process has progressed, the Board has amended the assumptions to include the ability to provide greater salary increases; to reduce the need to cut programs; and to balance the district’s revenues between M&O and I&S.

Initially, when looking at reducing expenditures, the district was using a three-year approach to cut $21 million in an effort to lessen the impact on any single year. As referenced on the Finance 101 page, 87 percent of the district’s budget is in payroll.

The Board stressed the importance of starting at the central administration level when looking at reductions and keeping campus-facing cuts to a minimum. And when making a reduction, to do so through attrition – cutting a currently vacant position – in an effort to not cut any existing staff.

At the April 7 Board meeting, the district identified and recommended cuts totaling $4.5 million mainly impacting the central administration level. The district also identified $2.6 million of cuts at the campus level, but it is not recommending these reductions for the 2022–23 fiscal year.

At the May 5 Board meeting, the district identified another way to create room in the operating budget by moving $5 million of projects under Major Maintenance and portables to be funded by 2017 Bonds savings, and these projects would be included in bond packages for future years.

In addition, the Board amended the budget assumptions to base 2022–23 revenues on a 9-cent VATRE and amended salary increases to provide 5% pay increase for teachers, nurses and counselors, a 4% increase for all other employees and a $15 minimum wage for hourly employees.

2022–23 Cuts

The district identified and moved forward with the following cuts in preparing the 2022–23 budget:

- $5 million decrease in major maintenance projects (to be funded by 2017 Bond savings)

- $1.2 million decrease by eliminating the ESS contracted services and bringing the substitute teacher program in-house.

- $1 million decrease in portables (to be funded by 2017 Bond savings)

- $955,252 decrease by redesigning bus routes to increase efficiency

Managing the Tax Rate

One way Leander ISD can bring in additional revenues is by increasing the M&O tax rate through a process called a Voter-Approval Tax Rate Election (VATRE) and offsetting that increase with an even greater decrease to the I&S tax rate. This would provide an overall total tax rate decrease to property owners.

By increasing the amount of funds generated by the M&O tax rate, the school district increases the portion of the budget used for paying teacher and staff salaries and benefits; student educational resources; classroom supplies and equipment; and contracted services – like utilities, insurance, legal and audit services, etc.

Note: Even with a decrease in the I&S tax rate, the amount of money available is sufficient to pay down existing debt due to the rise in local property values. For additional information about the I&S tax rate and the district’s amount of debt, visit the I&S section of the Finance 101 page.

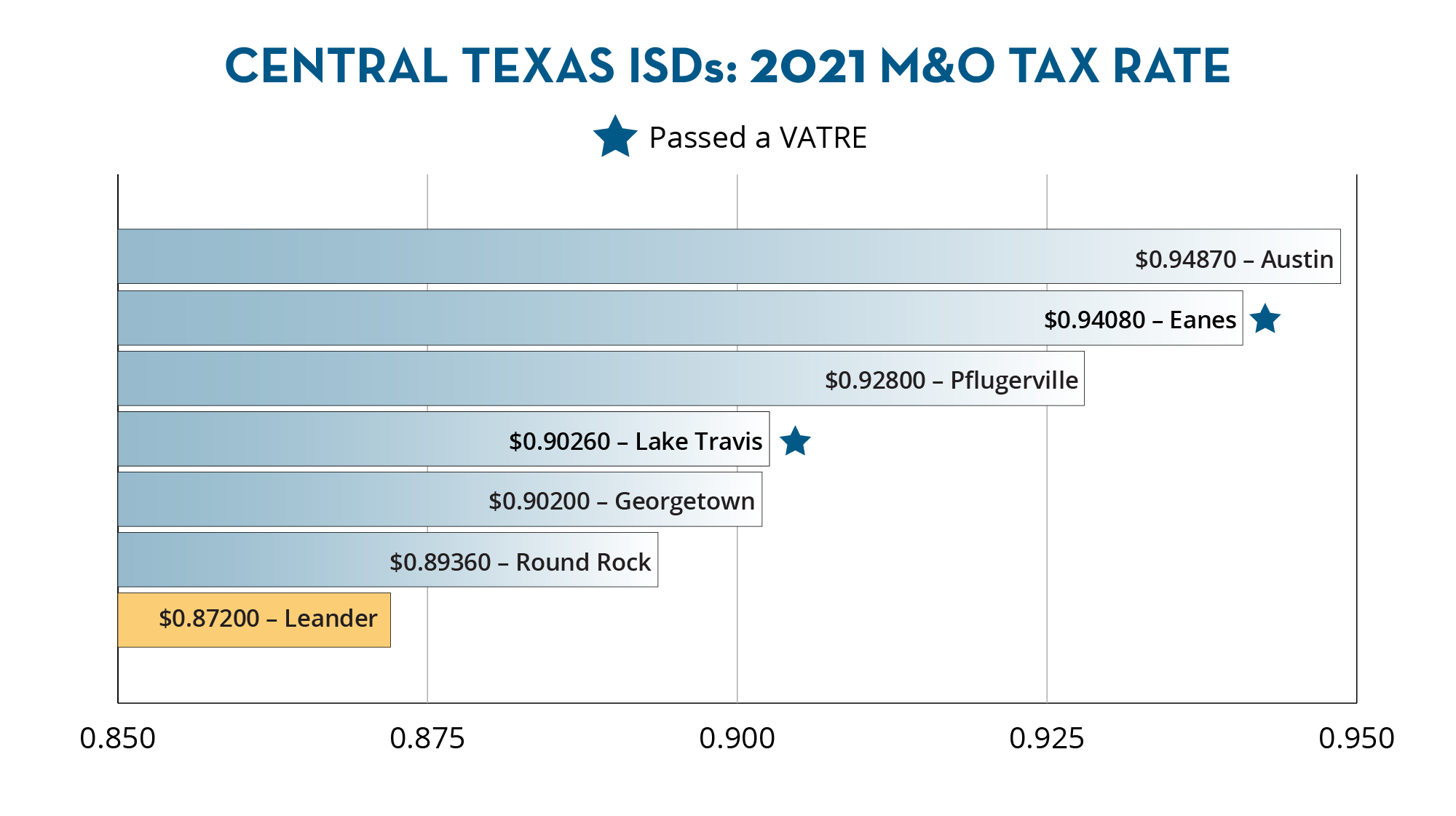

Compared to school districts in the Central Texas area in 2021, Leander ISD has the lowest M&O tax rate. Some neighboring districts have used a VATRE to increase the M&O tax rate, resulting in additional funds to use for operations, including teacher salaries.

If the board adopts a tax rate that is greater than the calculated rate set by law, that triggers a VATRE, which is held that November. If the voters do not approve the VATRE, then the M&O rate reverts to the maximum allowed under state law.

The exact number of additional pennies to the M&O tax rate would be set by the Board when they adopt the tax rate in August 2022.

9 Pennies

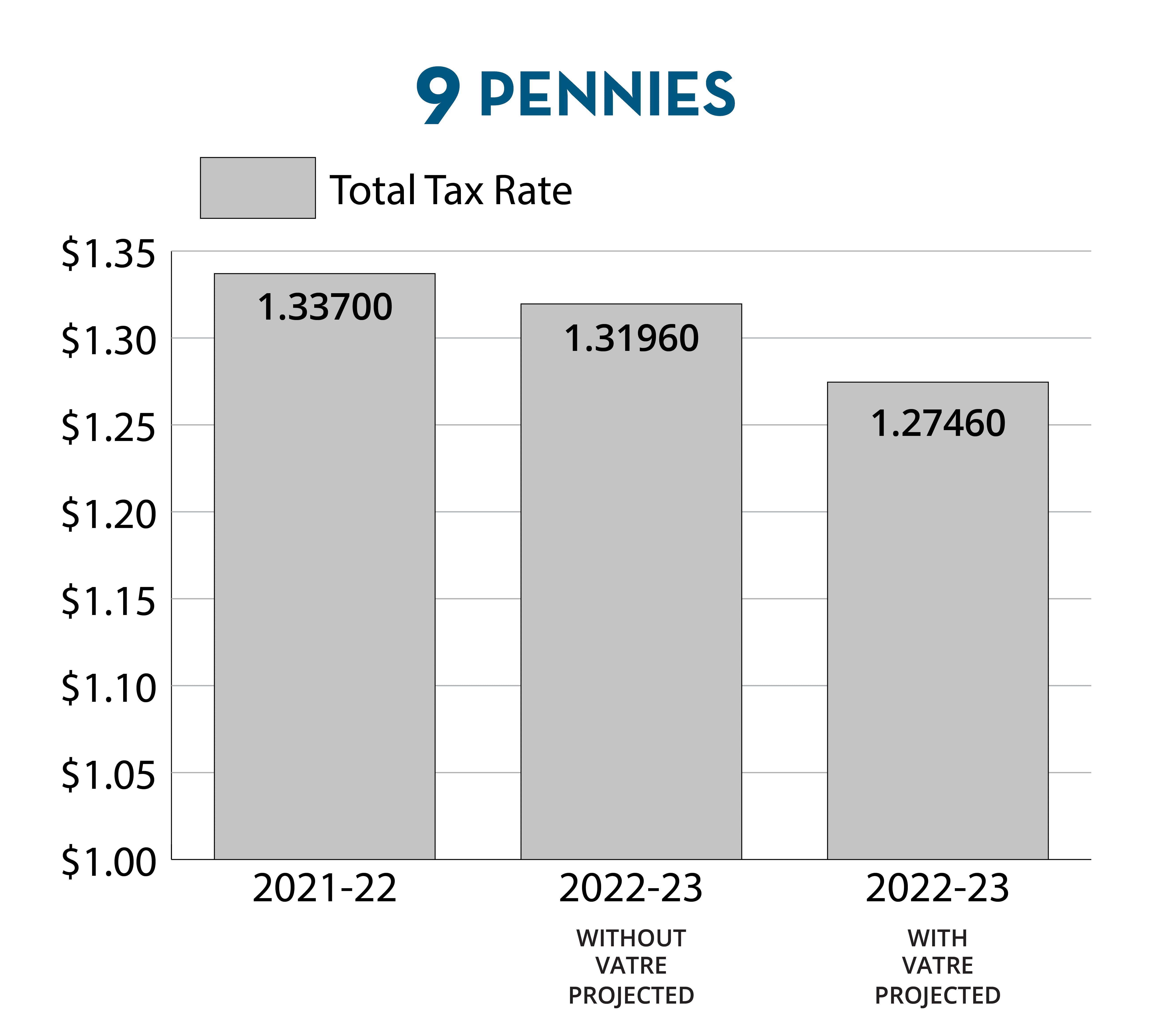

At the May 5 Board meeting, Trustees amended the assumptions toward building the 2022–23 budget to include 9 additional pennies – 3 additional Golden Pennies and 6 Copper Pennies. At the same time, the Board would lower the I&S tax rate by 13.5 pennies, bringing the resulting total tax rate to $1.27460.

- The 9-penny VATRE would also be a more than 6-cent reduction from the current 2021-22 total tax rate.

The 9-penny increase to M&O would result in an additional $30 million in revenue for Leander ISD. This increase in revenue – together with the identified reductions and moving of major maintenance and portables to be funded by 2017 Bond savings – results in a budgeted deficit of $5 million for 2022–23, an amount within the Board-set parameter of a deficit no larger than 4 percent of the total revenues.

This budget would include:

- A 5% pay increase for teachers, nurses and counselors and a 4% pay increase for all other employees (percentage increases applied to the midpoint of a scale)

- Increasing the minimum hourly wage to $15 per hour

- Reducing the overall tax rate by more than 6 cents

Note: Even with a decrease in the I&S tax rate, the amount of money available is sufficient to pay down existing debt due to the rise in local property values. For additional information about the I&S tax rate and the district’s amount of debt, visit the I&S section of the Finance 101 page.

Potential Outcomes of the VATRE

If the VATRE passes in the November 2022 election, the district would see a $30 million increase in revenues to support the increases in pay approved by the Board on May 19 in the 2022–23 compensation plan. The additional revenues also reduce the amount of cuts needed from existing personnel and programs.

If the VATRE does not pass, it would hurt the district’s ability to recruit and retain high-quality teachers and staff. The district would lose out on any additional revenue and would be left with a budget deficit of nearly $35 million for the 2022–23 school year. While fund balance would cover the costs for that school year, the school district would need to increase its amount of cuts in the following areas moving forward:

- A reduction of personnel resulting in increased class sizes

- Restructuring or eliminating certain programs that Leander ISD students and parents have come to expect