Leander ISD’s business office serves to advance the District’s efforts to provide the highest quality instructional programs by developing procedures and practices related to budget development and fiscal responsibility. We are committed to providing the community with transparent financial information in a format that is both easily accessible and understandable. This website provides financial information regarding Leander ISD’s revenues, expenditures, tax rates, cost drivers and other comparative data that allows the reader make an informed decision about the financial stability of the District.

Annual Comprehensive Financial Report

- 2024 Annual Comprehensive Financial Report

- 2023 Annual Comprehensive Financial Report

- 2022 Annual Comprehensive Financial Report

- 2021 Annual Comprehensive Financial Report

- 2020 Annual Comprehensive Financial Report

- 2019 Annual Comprehensive Financial Report

- 2018 Annual Comprehensive Financial Report

- Archived Annual Comprehensive Financial Reports (since 2012)

Budget Information

2025-26 Budget Information

- Notice of Public Meeting – Tax Rate Hearing August 21, 2025

- Adopted Budget 2025-26 (Amended with final Truth in Taxation worksheets)

- Adopted Budget 2025-26 – (Excel)

- Comparison of Proposed Budget to Prior Year

- Presentation of Proposed Budget for 2025-26

- Proposed Budget 2025-26

- Notice of Public Meeting – Budget Hearing June 19, 2025

2024-25 Budget Information

- 2024-25 High-Level Budget Overview

- 2024-25 Official Budget Book

- Adopted Budget 2024-25 (Amended with final Truth in Taxation worksheets)

- Adopted Budget 2024-25 – (Excel)

- Comparison of Proposed Budget to Prior Year

- Presentation of Proposed Budget for 2024-25

- Proposed Budget 2024-25

- Notice of Public Meeting – Budget Hearing June 27, 2024

2023-24 Budget Information

- 2023-24 High-Level Budget Overview

- 2023-24 Official Budget Book

- Adopted Budget 2023-24 (Amended with final Truth in Taxation worksheets)

- Adopted Budget 2023-24 – (Excel)

- Comparison of Proposed Budget to Prior Year

- Presentation of Proposed Budget for 2023-24

- Proposed Budget 2023-24

- Notice of Public Meeting – Budget Hearing June 15, 2023

2022-23 Budget Information

- 2022-23 High-Level Budget Overview

- 2022-23 Official Budget Book

- Adopted Budget 2022-23

- Notice of Public Meeting – Budget Hearing June 23, 2022

- Comparison of Proposed Budget to Prior Year

- Presentation of Proposed Budget for 2022-23

- Proposed Budget 2022-23

- Notice of Public Meeting – Tax Rate Hearing August 18, 2022

2021-22 Budget Information

- 2021-22 High-Level Budget Overview

- 2021-22 Official Budget Book

- Adopted Budget 2021-22

- Notice of Public Meeting – Budget Hearing June 17, 2021

- Comparison of Proposed Budget to Prior Year

- Presentation of Proposed Budget for 2021-22

- Proposed Budget 2021-22

- Proposed Budget 2021-22 (Amended with final Truth in Taxation worksheets)

- Focus on Finance – Issue 1 – December 2021

- Focus on Finance – Issue 2 – December 2021

- Focus on Finance – Issue 3 – December 2021

2020-21 Budget Information

- Adopted Budget 2020-21

- Notice of Public Meeting – Budget Hearing June 18, 2020

- Comparison of Proposed Budget to Prior Year

- Presentation of Proposed Budget for 2020-21

- Proposed Budget 2020-21

- Focus on Finance – Issue 1

- Focus on Finance – Issue 2

- Focus on Finance – Issue 3

- Focus on Finance – Issue 4

Archived Budget Documents

Check Registers

2025–26 Monthly Check Registers

Check Registers by Fiscal Year

Debt Management

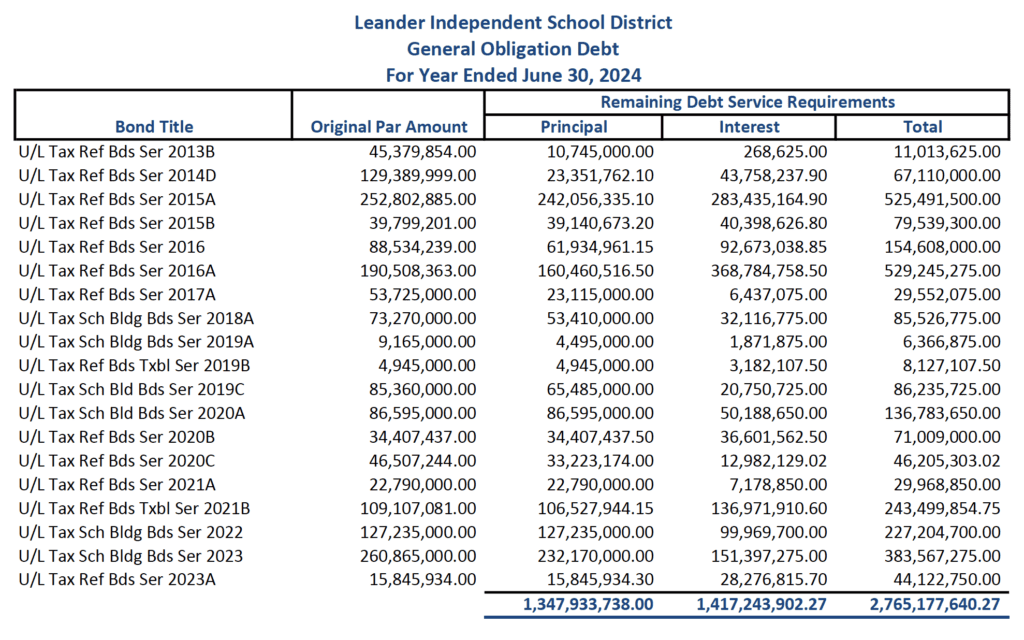

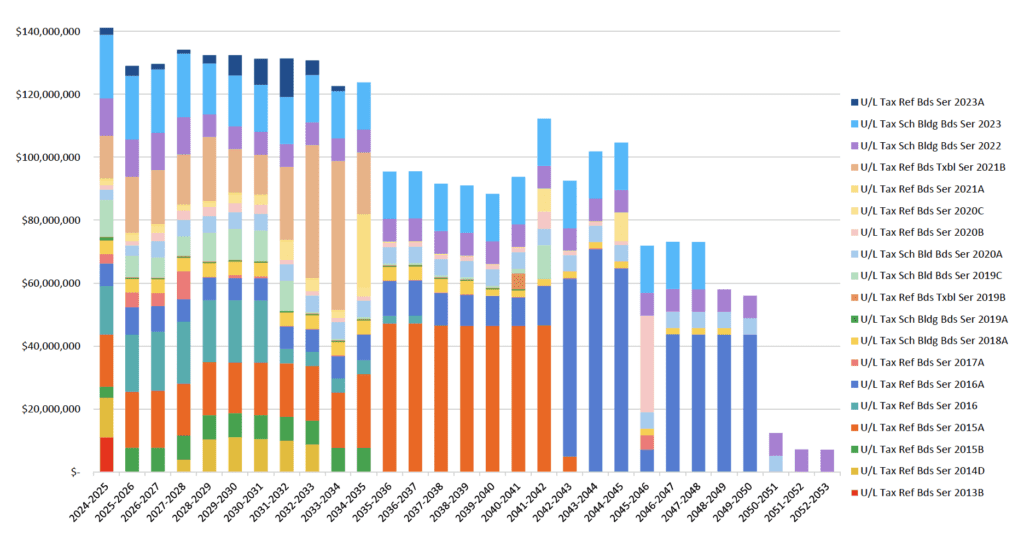

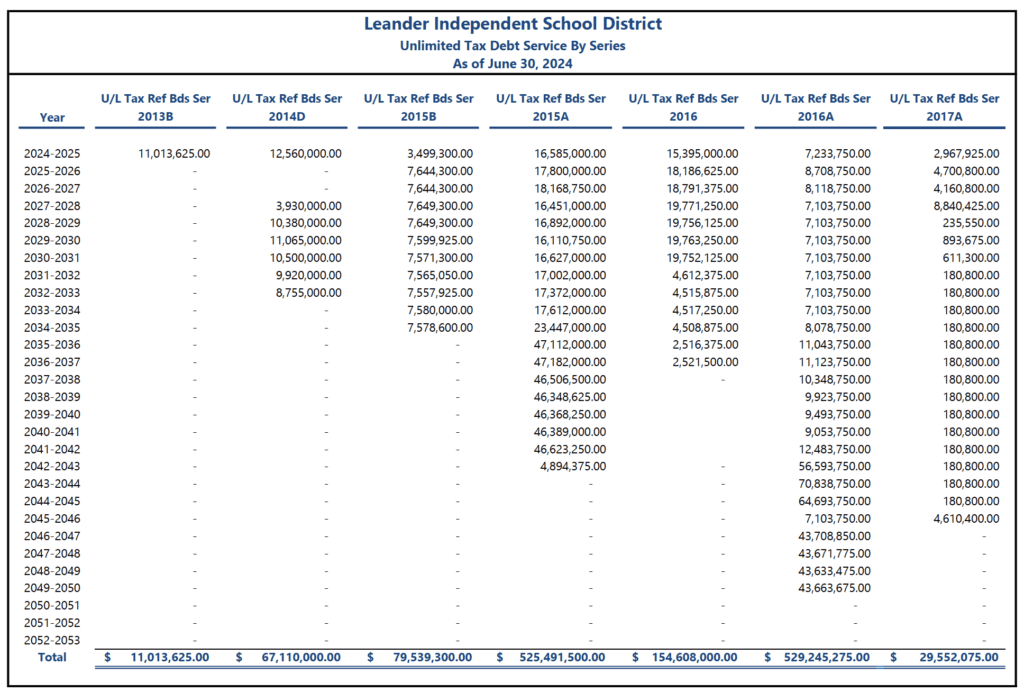

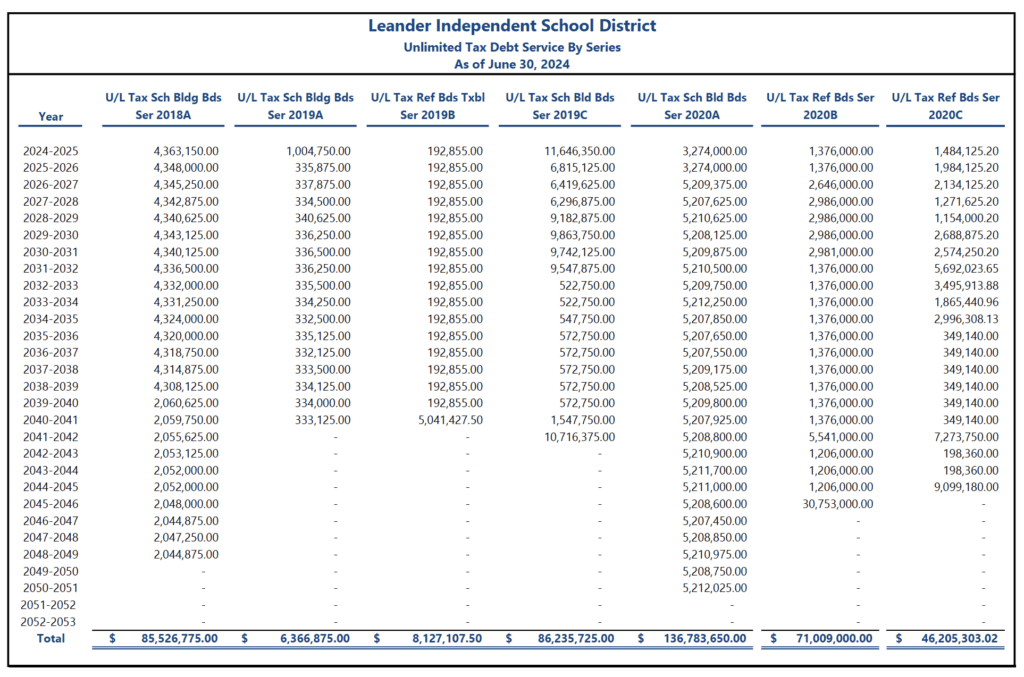

The following information is prepared for Leander ISD taxpayers to provide transparent information regarding the District’s debt obligations.

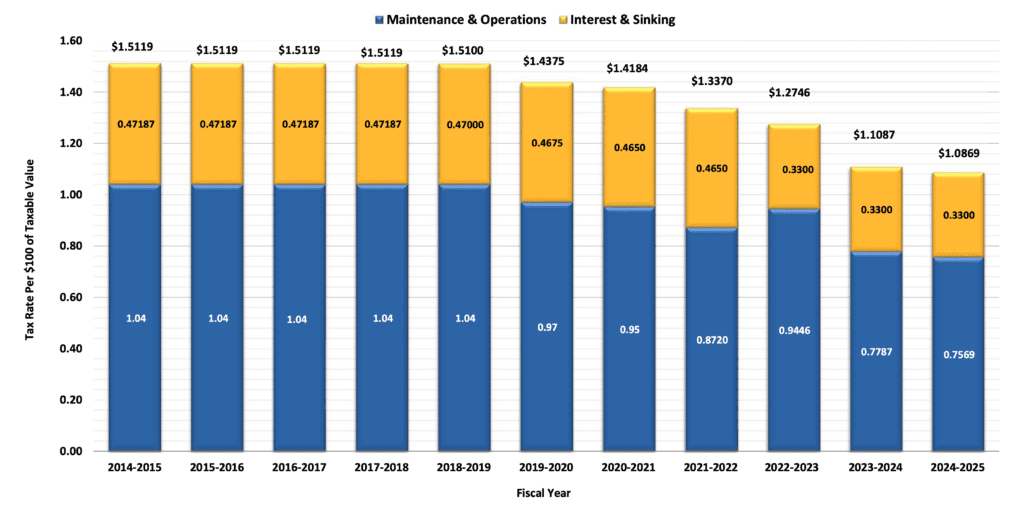

2024-25 Tax Rates

- M&O Tax Rate: $0.7569 per $100 of taxable value

- I&S Tax Rate: $0.3300 per $100 of taxable value

- Total Combined Tax Rate: $1.0869 per $100 of taxable value

2023-24 Tax Rates

- M&O Tax Rate: $0.7787 per $100 of taxable value

- I&S Tax Rate: $0.3300 per $100 of taxable value

- Total Combined Tax Rate: $1.1087 per $100 taxable value

2022-2023 Tax Rates

- M&O Tax Rate: $0.9446 per $100 of taxable value

- I&S Tax Rate: $0.3300 per $100 of taxable value

- Total Combined Tax Rate: $1.2746 per $100 taxable value

In 2022, the Board of Trustees approved adding 3 additional golden pennies to the 5 already existing, and

6 copper pennies to the Tier 2 portion of the tax rate bringing the total M&O tax rate to $0.9446. The I&S

tax rate for 2022 was reduced to $0.3300. The total tax rate adopted was $1.2746 which was a decrease

of 6.24 cents from the prior year. The tax total rate was approved by voters in the November 8, 2022

Voter-Approval Tax Ratification Election.

2021-2022 Tax Rates

- M&O Tax Rate: $0.8720 per $100 of taxable value

- I&S Tax Rate: $0.4650 per $100 of taxable value

- Total Combined Tax Rate: $1.3370 per $100 taxable value

2020-2021 Tax Rates

- M&O Tax Rate: $0.9534 per $100 of taxable value

- I&S Tax Rate: $0.4650 per $100 of taxable value

- Total Combined Tax Rate: $1.4184 per $100 taxable value

Debt Portfolio Update Progress Report – June 2021

Current Credit Rating

| AGENCY | PSF RATING | SCHOOL ISSUERS CREDIT | UPDATED |

| Fitch | AAA | AA+ | July 10, 2024 |

| Standard and Poor’s | AAA | AA | July 13, 2023 |

- Fitch Ratings Upgrade – July 2024

- Fitch Ratings – July 2023

- S&P Ratings – July 2023

- Fitch Ratings – September 2022

- S&P Ratings – September 2022

- Fitch Ratings Upgrade – September 2021

- S&P Global Rates – June 2021

Authorized General Obligation Bonds – (As of 6/30/24)

| Election Date | Prop | Purpose | Amount ($000s) | For/Against | Issued ($000s) | Unissued ($000s) |

|---|---|---|---|---|---|---|

| May 2023 | Prop A | School Building & Buses | $698,300 | 62.0 % Approved | $225,324 | $473,066 |

| May 2023 | Prop B | Technology | $50,800 | 64.4 % Approved | $0 | $50,800 |

| May 2023 | Prop C | Performing Arts | $13,600 | 60.5 % Approved | $0 | $13,600 |

| November 2021 | Prop A | School Building & Buses | $727,210 | 50.5% Against | N/A | N/A |

| November 2021 | Prop B | Technology | $33,298 | 52% Approved | $28,561 | $4,737 |

| November 2021 | Prop C | Performing Arts | $11,662 | 51.9% Against | N/A | N/A |

| November 2017 | Prop 1 | School Building & Technology | $454,405 | 65.9% Approved | $446,015 | $8,390 |

| November 2007 | Prop 1 | School Building | $559,000 | 55.7% Approved | $559,000 | — |

| May 2006 | Prop 1 | School Building | $286,116 | 59.5% Approved | $286,116 | — |

| May 2006 | Prop 2 | Stadium | $6,900 | 55.7% Against | N/A | N/A |

| May 2006 | Prop 3 | Aquatic | $7,000 | 57.0% Against | N/A | N/A |

| February 2003 | Prop 1 | School Building | $189,900 | 57.2% Approved | $189,900 | — |

| February 2000 | Prop 1 | School Building | $177,200 | 72.2% Approved | $177,200 | — |

| January 1997 | Prop 1 | School Building & Improvements | $79,000 | 59.9% Approved | $79,000 | — |

Historical Tax Rates

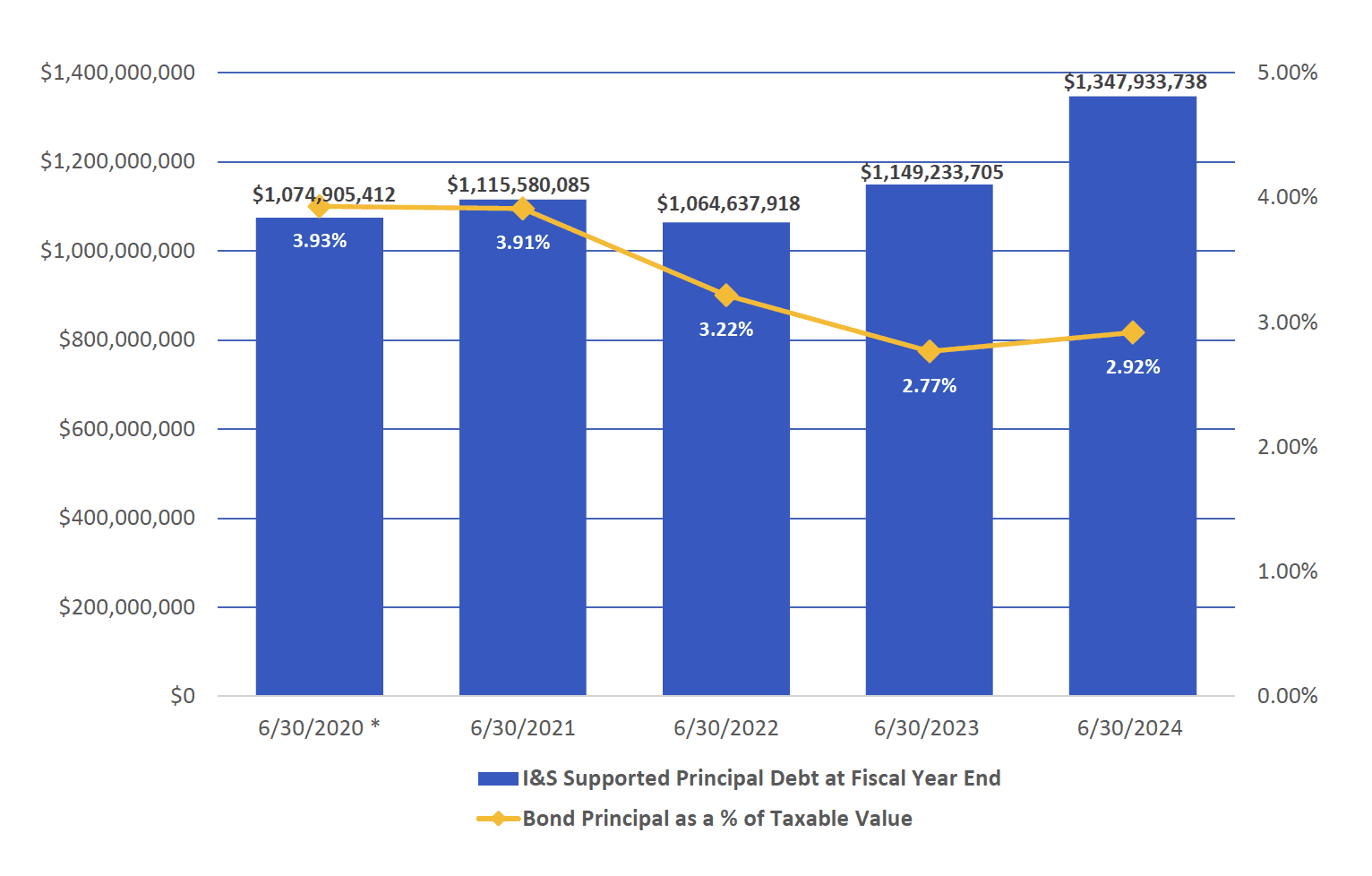

Leander ISD Tax-Supported Debt – 5 Year History

* The district changed its fiscal year end in 2020. Due to switching to a June 30 year end, the district’s outstanding debt was unchanged from 8/31/2019 as principal payments were not recorded in fiscal year end 6/30/2020.

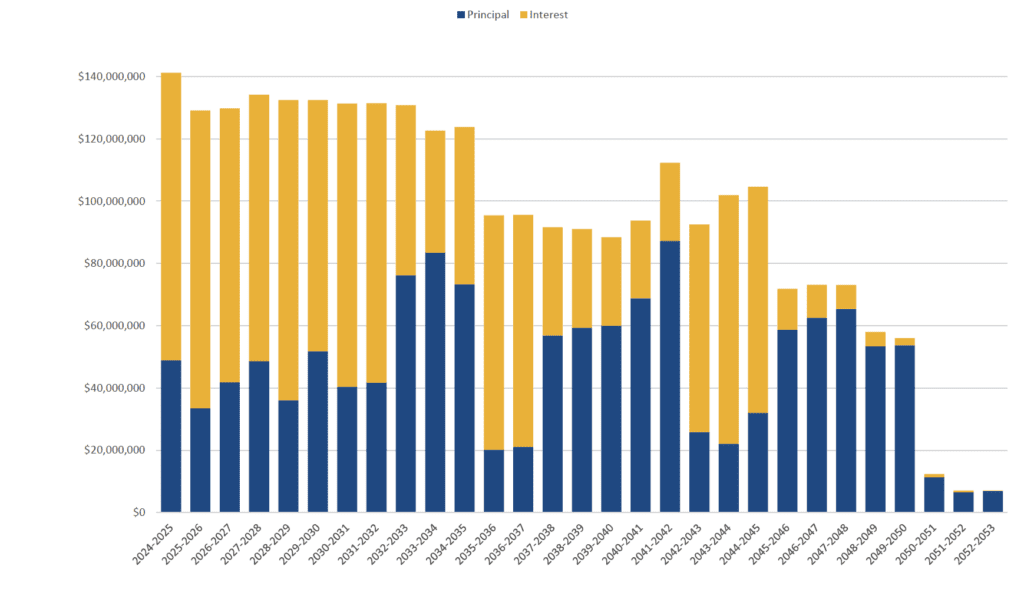

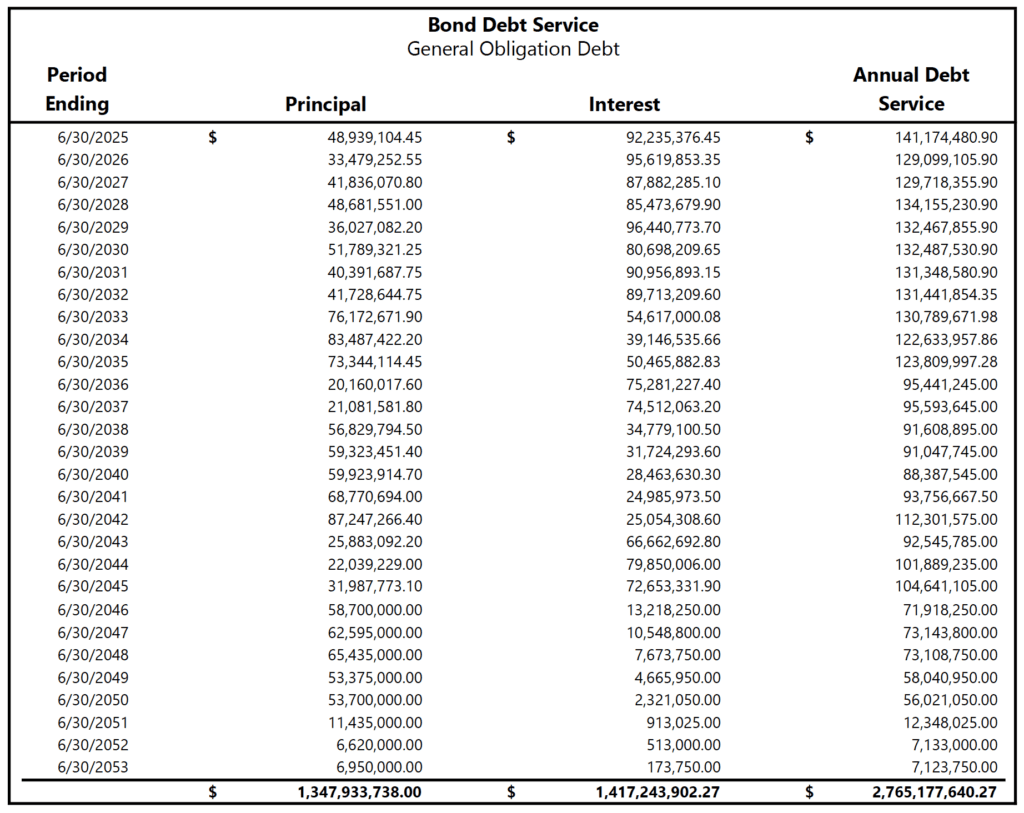

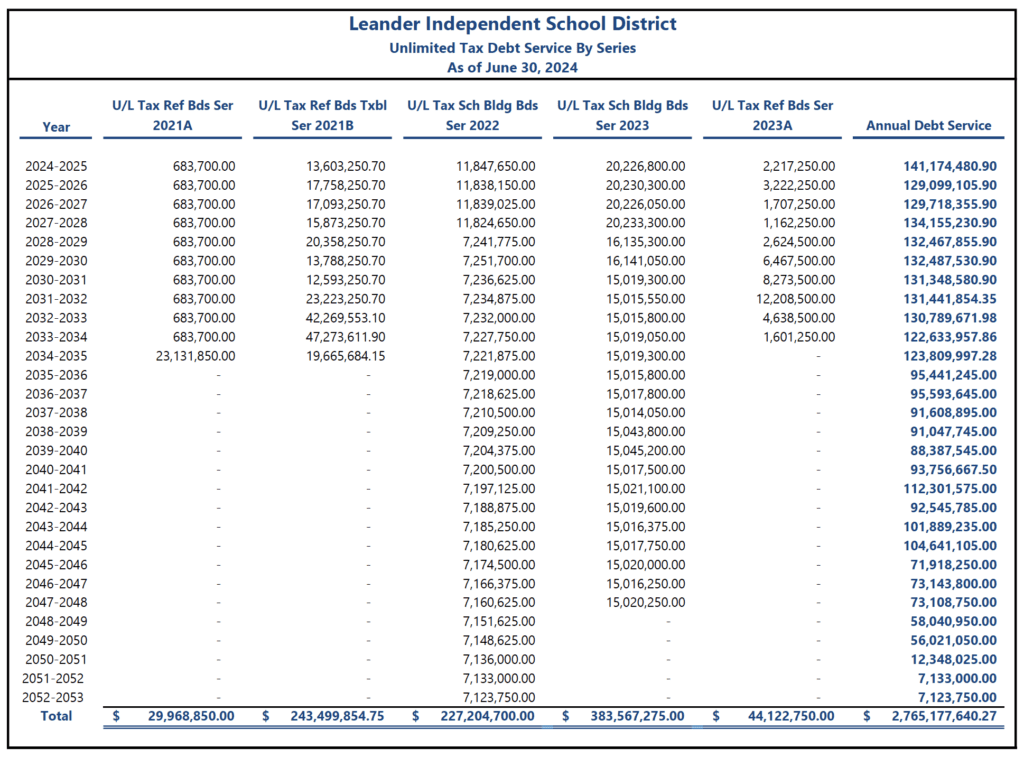

Debt Obligation by Fiscal Year – (Principal & Interest as of 6/30/24)

Debt Obligation by Series

Debt Obligation by Series and Fiscal Year

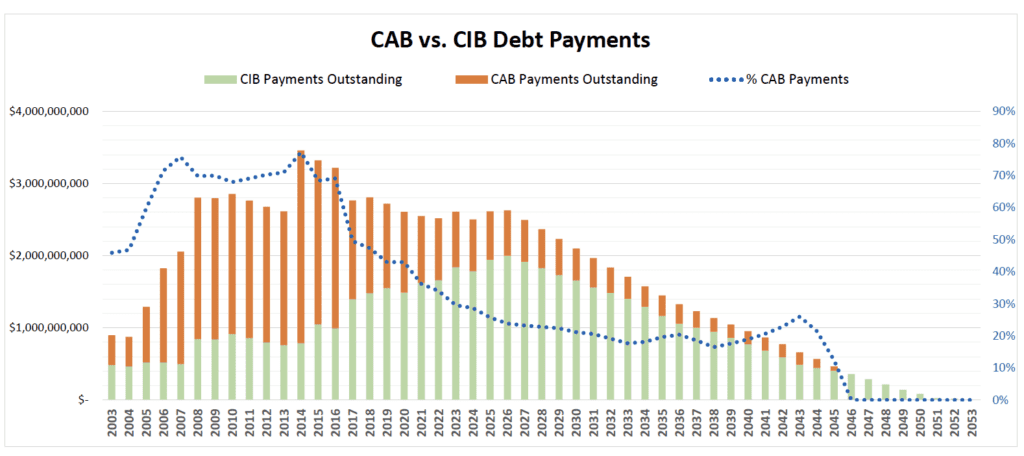

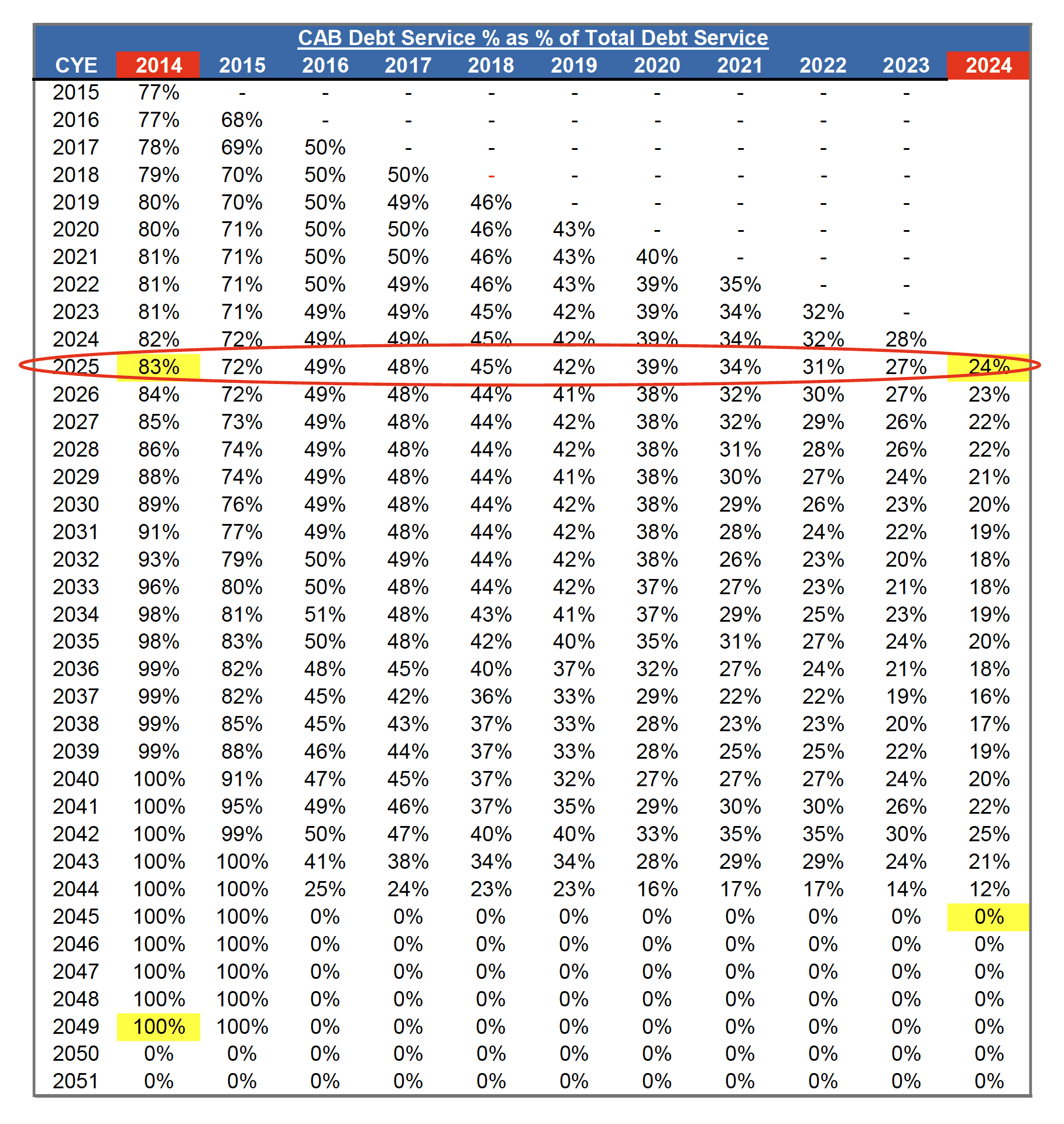

Debt Profile Transformation

Current Interest Bond (CIB) – CIBs are debt instruments that require annual installments back to investors.

Debt Profile Transformation

In 2024, the percentage of CAB debt due for Calendar Year End (CYE) 2025 is 24% and decreases to 0% in 2045.

Other Sources for Information

Disclosure

Policies and Procedures

Public Finance Team

Statistics, Ratings, and Presentations

District Contact Information

Leander ISD

204 W. South Street P.O. Box 218

Leander, TX 78646-0218

Phone: 512-570-0000

Fax: 512-570-0054

District Receptionists:

Martha Hinojosa

email: [email protected]

Ashley Frick

email: [email protected]

For a districtwide staff listing, visit the Staff Directory page.

Energy Usage

ESSER III

Financial Integrity Rating System of Texas (FIRST)

Historical Staff Full-Time Equivalent (FTE)

| Fiscal Year | Total Staff (FTE) |

| 2019-2020 | 5,026.7 |

| 2020-2021 | 5,262.5 |

| 2021-2022 | 5,289.8 |

| 2022-2023 | 5,277.1 |

Members of the LISD Board

For a districtwide staff listing, visit the Staff Directory page.

To communicate with the entire board, email [email protected].

Monthly Financial Reports

Public Comments on Proposed Rulemaking

The Texas Education Agency (TEA) has requested that we publish these links to encourage boards of trustees/governing boards, administrators, teachers, and parents to participate in the process for adopting rules that affect public education in Texas. It will also assist in complying with the requirements of Texas Education Code (TEC), §39.001, which requires the commissioner of education to solicit input from stakeholders who may be affected by proposed rules adopted under TEC, Chapter 39, Public School System Accountability.

The links are as follows:

Tax Rates

Important Information

Visit Texas.gov/PropertyTaxes to find a link to your local property tax database on which you can easily access information regarding your property taxes, including information regarding the amount of taxes that each entity that taxes your property will impose if the entity adopts its proposed tax rate. Your local property tax database will be updated regularly during August and September as local elected officials propose and adopt the property tax rates that will determine how much you pay in property taxes.

Current Tax Rate

There are two components to the 2024 total property tax rate of $1.0869.

The first component of the total tax rate is the Maintenance & Operations (M&O) rate of $0.7569. The tax collections from this part of the tax rate provide revenues to fund the District’s daily operating costs such as payroll for teachers and staff, supplies, transportation, and utilities.

The second component is the Interest & Sinking (I&S) rate of $0.3300. These tax collections provide the funds necessary to pay the interest and principal on outstanding bonds issued by the District over the years. Per State law, these tax collections can only be used for the retirement of debt.

The funds that result from the issuance of bonds are referred to as bond or capital project funds and can only be used to build and maintain district facilities and to fund other capital improvements and equipment, such as technology and buses. It is important to note that these funds cannot be used on teacher salaries. Once construction and/or projects are completed, any funds that remain from the issuance of bonds can be used for new projects allowable under the bond orders or the retirement of debt. The Board must approve the use of remaining bond funds.

LISD has lowered its total tax rate for the last seven years. Below are links to the calculation worksheets for the 2024 No‐New‐Revenue and Voter‐Approval rates developed throughout the tax rate adoption process.

Notice of Public Meeting – Budget Hearing June 27, 2024

Tax Rate Calculation Worksheets (Preliminary Values)

Final Tax Rate Calculation Worksheets (Certified Values)

Adopting a Budget and Tax Rate

Local officials in cities, counties, school districts, and special purpose districts (such as hospitals, junior colleges, or water districts) adopt tax rates on an annual basis that are applied to the appraised values of all nonexempt property in the state. Each taxing unit must determine the level of revenue required to cover operations and pay for voter approved bonds.

The taxing entity’s No‐New‐Revenue (NNR) rate is established based on the tax rate required to generate the same amount of revenue in the previous year on properties taxed in both years; therefore, if property values increase, the NNR tax rate will decrease, or if property values decline, the NNR tax rate will rise. The actual tax rate is determined by the budget that is adopted by the governing body of the taxing entity.

In a Robin Hood district, it is important to note another term: the “Rate to Maintain.” The school district’s Rate to Maintain tax rate is established based on the tax rate required to generate the same amount of tax and state revenues (this includes additional revenues needed to make recapture payment to the State) in the previous year on properties taxed in both years. The Rate to Maintain and the Proposed Rate are published each year prior to the budget and tax rate adoption.

M&O Tax Rate

School districts and cities fall under different laws when it comes to adopting a tax rate. Cities have flexibility in setting their tax rate, whereas the largest portion of a school district’s M&O tax rate, the Maximum Compressed Rate (MCR), is capped by the state legislation that the Governor signed into law in June 2019. This law requires school districts to lower their MCR portion of the M&O tax rates based on property value growth each year.

The M&O tax rate is broken up into two tiers and HB 3 in 2019 made changes to the calculations of both tiers. The Tier 1 tax rate is based on the growth or decline in local and statewide property values. This tax rate is calculated by the State and not by LISD. Legislation from the 88th Session in 2023 provided for additional compression of the MCR in response to the historic growth in Texas property values. Based on the mandatory state compression and the property value growth for 2024, LISD’s 2024 M&O Tier 1 tax rate decreased from $0.6387 cents to $0.6169 cents.

The Tier 2 tax rate was capped at $0.04 cents in 2019 with the passage of HB 3. The State gave some flexibility to increase this rate by $0.01 cent in 2020. The Tier 2 tax rate contains what are considered “golden pennies,” which means that 100% of the revenue raised from this portion of the tax rate stays in LISD and would not be subject to recapture. The other portion of the Tier 2 tax rate contains “copper pennies” and revenues generated by these pennies are subject to recapture. In 2022, the Board of Trustees approved adding 3 additional golden pennies to the 5 already existing, and 6 copper pennies to the Tier 2 portion of the tax rate. The addition of these Tier 2 pennies was approved by voters in the November 8, 2022, Voter‐Approval Tax Ratification Election. The Tier 2 tax rate is $0.1400 cents and when combined with the Tier 1 tax rate of $0.6169, brings the total 2024 M&O tax rate to $0.7569.

Historical Tax Rates

| Fiscal Year | Maintenance & Operations (M&O) | Interest & Sinking (I&S) | Total Tax Rate |

|---|---|---|---|

| 2024-25 | 0.75690 | 0.33000 | 1.08690 |

| 2023-24 | 0.77870 | 0.33000 | 1.10870 |

| 2022-23 | 0.94460 | 0.33000 | 1.27460 |

| 2021-22 | 0.87200 | 0.46500 | 1.33700 |

| 2020-21 | 0.95340 | 0.46500 | 1.41840 |

| 2019-20 | 0.97000 | 0.46750 | 1.43750 |

| 2018-19 | 1.04000 | 0.47000 | 1.51000 |

| 2017-18 | 1.04000 | 0.47187 | 1.51187 |

| 2016-17 | 1.04000 | 0.47187 | 1.51187 |

| 2015-16 | 1.04000 | 0.47187 | 1.51187 |

| 2014-15 | 1.04000 | 0.47187 | 1.51187 |

| 2013-14 | 1.04000 | 0.47187 | 1.51187 |

Truth in Taxation

Resources

Preceding Budgets

Adopted Current Budget

Budget Comparison

District’s Most Recent Financial Audit

Contact Leander ISD

Address:

Leander ISD

204 W. South Street P.O. Box 218

Leander, TX 78646-0218

Phone: 512-570-0000

[email protected]