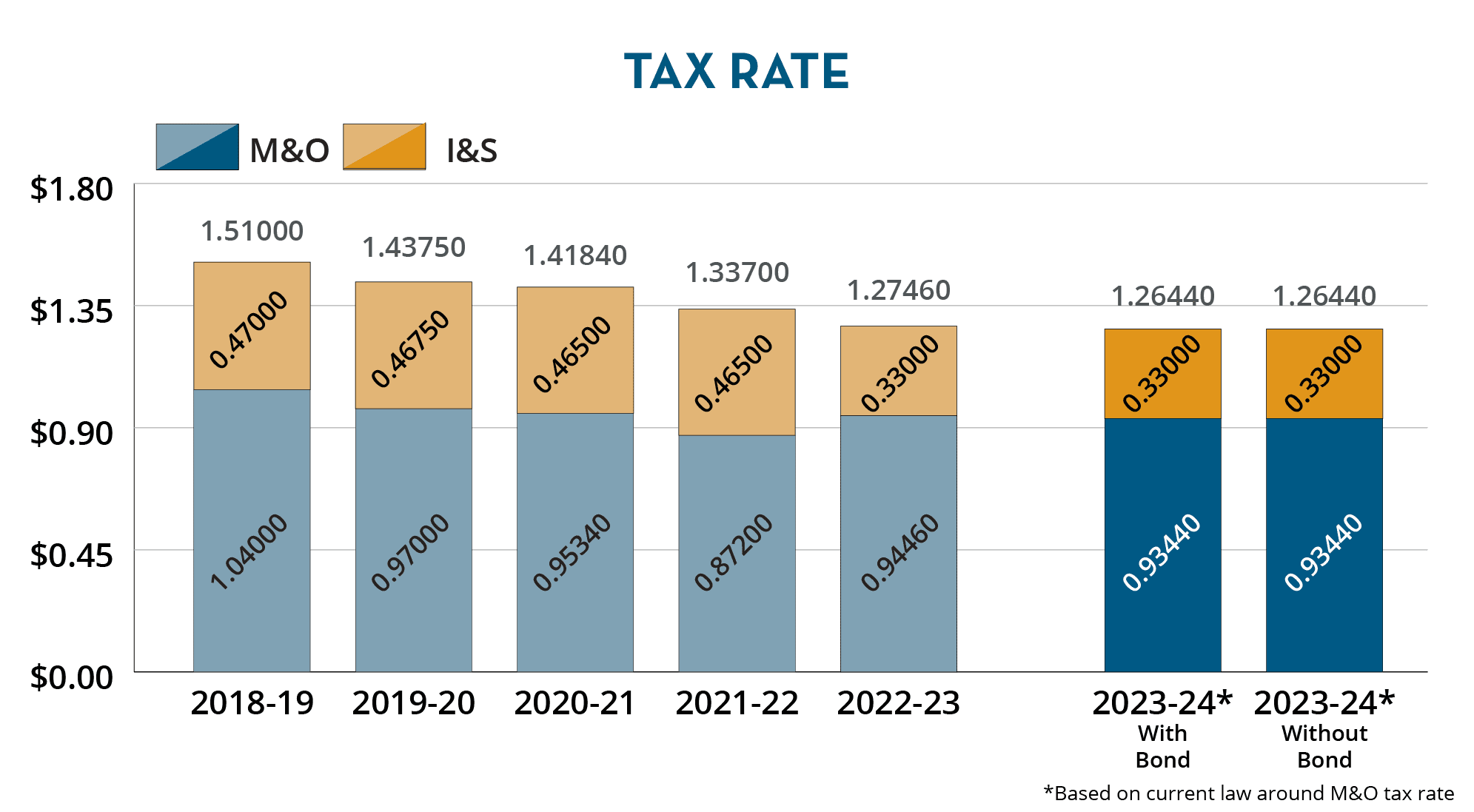

Important: A new state law requires all school district bond referendum ballots to be printed with “THIS IS A PROPERTY TAX INCREASE.” While this is legally required language, the Leander ISD bond referendum WILL NOT increase your property tax rate.

Safety & Security Projects

at Every Campus

Each campus would receive safety and security upgrades, including new and replaced cameras, exterior layers, alert systems, digital mapping and automatically locking door handles, as well as network firewalls to protect against cyber attacks.

Renovated & New

Schools

The bond propositions call for maintenance and modernization projects at numerous district schools. They also include the construction of two new elementary schools and the design of a new facility for LISD’s Early College High School.

Replacement of

Devices & Infrastructure

The bond propositions include the installation of interactive flat panels in every classroom, network updates, replacement of technological devices, new band instruments, a new transportation hub to serve southern LISD, and replacement of some buses and vans.

No Change in District

Tax Rate

The Leander ISD tax rate will not change as a result of whether votes approve or defeat the bond propositions. Continued growth in the district’s tax base will allow the district to fund the projects with the existing debt service tax rate of 33 cents per $100 property valuation.

Prop A: $698.33 million for school facilities, buses and vehicles

Prop B: $50.82 million for technology equipment and infrastructure

Prop C: $13.67 million for renovations to LISD’s 2 performing arts centers

Informational Videos

Anticipated Bond Projects

Additional Information About Props A, B, C

In 2019, the Texas Legislature enacted a requirement that school districts list certain types of projects, such as construction of or renovation to fine arts facilities, as separate propositions. This is one reason why the LISD bond is presented in the form of three different propositions.

Prop A

$698.33 million for school facilities including two new elementary schools and the purchase of land for future school facilities. It includes safety and security projects at every campus in LISD, as well as renovations and/or modernization projects at numerous campuses, plus the purchase of new school buses and other vehicles needed for district operations.

Ballot Language (For / Against)

“THE ISSUANCE OF $698,330,000 OF BONDS BY THE LEANDER INDEPENDENT SCHOOL DISTRICT FOR SCHOOL FACILITIES, THE PURCHASE OF NECESSARY SITES FOR SCHOOL FACILITIES, BUSES AND VEHICLES AND THE IMPOSITION OF A TAX SUFFICIENT TO PAY THE PRINCIPAL OF AND INTEREST ON THE BONDS AND THE COST OF ANY CREDIT AGREEMENTS. THIS IS A PROPERTY TAX INCREASE.”

Prop B

$50.82 million for technology equipment and technology infrastructure, including the replacement of devices for students and staff and computer network projects.

Ballot Language (For / Against)

“THE ISSUANCE OF $50,820,000 OF BONDS BY THE LEANDER INDEPENDENT SCHOOL DISTRICT FOR TECHNOLOGY EQUIPMENT AND TECHNOLOGY INFRASTRUCTURE AND THE IMPOSITION OF A TAX SUFFICIENT TO PAY THE PRINCIPAL OF AND INTEREST ON THE BONDS AND THE COST OF ANY CREDIT AGREEMENTS. THIS IS A PROPERTY TAX INCREASE.”

Prop C

$13.67 million for renovations to Don Tew Performing Arts Center and South Performing Arts Center.

Ballot Language (For / Against)

“THE ISSUANCE OF $13,670,000 OF BONDS BY THE LEANDER INDEPENDENT SCHOOL DISTRICT FOR RENOVATIONS TO DON TEW PERFORMING ARTS CENTER AND SOUTH PERFORMING ARTS CENTER AND THE IMPOSITION OF A TAX SUFFICIENT TO PAY THE PRINCIPAL OF AND INTEREST ON THE BONDS AND THE COST OF ANY CREDIT AGREEMENTS. THIS IS A PROPERTY TAX INCREASE.”

Understanding the Ballot Language

A state law passed in 2019 requires all school bond elections to include the following language: “THIS IS A PROPERTY TAX INCREASE.” This state mandates all bond ballots to include this language regardless of what impact the bond election will have on the tax rate. The passage or failure of the 2023 bond propositions will not impact the Leander ISD tax rate.

Limit on School Taxes for Senior Citizens

School property taxes are frozen for homeowners who qualify for a homestead exemption because they are disabled or age 65 or older. Their taxes can go down, but not up. While the tax rate will not increase for any LISD property owner if voters approve any or all of the bond propositions, individuals who have this exemption have added protection from the impact of rising property values – taxes you owe will not increase.

Town Hall Presentations

Come join us for one of our Bond 2023 information presentations hosted by LISD Superintendent Bruce Gearing, Ed.D. These sessions are open to the public and will provide first-hand opportunities to learn more about the bond.

- Noon Wednesday, March 29, at Don Tew PAC at Leander HS (3301 S. Bagdad Rd., Leander)

- 8 a.m. Thursday, April 13, at Site of Proposed South Transportation Facility, located next to Grandview Hills ES (12024 Vista Parke Dr., Austin)

- 6 p.m. Monday, April 17, at Cedar Park HS Library (2150 Cypress Creek Rd., Cedar Park)

- 6 p.m. Wednesday, April 19, Virtual

Zoom: Webinar Recording - 8 a.m. Friday, April 21, at Science Materials Center (900 W. New Hope Dr., Cedar Park)

Fiscal Management Highlights

- Leander ISD has recently saved taxpayers over $3.5 million through a bond refinancing opportunity.

- If passed, this Bond won’t be sold all at once. Bonds are authorized by voters and are sold in increments over time as needed to fund the projects.

- State law allows for bonds to be financed for up to 40 years. However, Leander ISD’s repayment schedules are matched up with the useful life of the assets being constructed or purchased. Leander ISD generally limits the maximum term to 30 years.

- The Board has a stated goal of reducing debt from Capital Appreciation Bonds (CABs) to 25 percent by 2025, and this is currently on target. Since 2015, Leander ISD has reduced CAB debt by 61 percent.

- Leander ISD maintains high credit ratings from bond-rating agencies. Leander ISD’s bonds are currently rated AA from S&P and from Fitch. LISD moved to an AA rating from Fitch in 2021, and this AA rating was recertified by both agencies in Fall 2022.

Voter Information

Key Dates

Voter Registration Deadline

Start of Early Voting

Deadline for counties to receive mail-in ballot requests

End of Early Voting

Election Day

If you need to update your name and/or address, check out this link from the Texas Secretary of State website.

Remember that Thursday, April 6, is the last day to register to vote!

Early Voting & Election Day Hours

Williamson County Voting Hours

Monday–Saturday, April 24–29: 8 a.m. to 6 p.m.

Sunday, April 30: No voting

Monday–Tuesday, May 1–2: 7 a.m. to 7 p.m.

Saturday, May 6: 7 a.m. to 7 p.m.

Travis County Voting Hours

Monday–Saturday, April 24–29: 7 a.m. to 7 p.m.

Sunday, April 30: 12 p.m. to 6 p.m.

Monday–Tuesday, May 1–2: 7 a.m. to 7 p.m.

Saturday, May 6: 7 a.m. to 7 p.m.

Voting Locations

You must vote in the county in which you reside. However, in both Williamson and Travis counties, you can vote early — and on Election Day — at any voting site in the county.

Early Voting Locations: Williamson County

Early Voting Locations: Travis County

Election Day Locations: Williamson County

Election Day Locations: Travis County

Voter ID Requirements

Under Texas law, voters who possess one of the seven acceptable forms of photo ID must present that ID at the polls when voting in person. Voters who do not possess and cannot reasonably obtain one of the seven approved forms of photo ID may fill out a Reasonable Impediment Declaration (RID) at the polls and present an alternative form of ID, such as a utility bill, bank statement, government check, or a voter registration certificate.

Here is a list of the acceptable forms of photo ID:

- Texas Driver License issued by the Texas Department of Public Safety (DPS)

- Texas Election Identification Certificate issued by DPS

- Texas Personal Identification Card issued by DPS

- Texas Handgun License issued by DPS

- United States Military Identification Card containing the person’s photograph

- United States Citizenship Certificate containing the person’s photograph

- United States Passport (book or card)

Resources

Have a question? Submit your question through Let’s Talk or by texting 512-399-0068.

Information Sessions

- Presentation Slides

- Request an in-person informational presentation

- Bond 2023 Town Hall Meetings:

- Noon Wednesday, March 29, at Don Tew PAC at Leander HS (3301 S. Bagdad Rd., Leander)

- 8 a.m. Thursday, April 13, at Site of Proposed South Transportation Facility, located next to Grandview Hills ES (12024 Vista Parke Dr., Austin)

- 6 p.m. Monday, April 17, at Cedar Park HS Library (2150 Cypress Creek Rd., Cedar Park)

- 6 p.m. Wednesday, April 19, Virtual

Zoom: Webinar Recording - 8 a.m. Friday, April 21, at Science Materials Center (900 W. New Hope Dr., Cedar Park)

Print & Digital Materials

- Informational Flyer

- Index Card

- Feeder Pattern Posters

- Additional Flyers

- Baseball & Softball Fields – 8.5×11 Handout

Baseball & Softball Fields – 11×17 Poster - Fine Arts – 8.5×11 Handout

- Performing Arts Centers – 8.5×11 Handout

Performing Arts Centers – 11×17 Poster - Plant Services – 11×17 Poster

- Special Education 18+ Transition Services – 11×17 Poster

- Transportation – 11×17 Poster

- Baseball & Softball Fields – 8.5×11 Handout

- Downloadable Social Media Graphics

Additional Resources

- Remind: To receive Bond 2023 information and be the first to know key updates, text @LISDbond to 81010 to sign up in Remind.

- Smart Money: School Finance website

- Visit the Financial Transparency page for detailed information about the district’s finances.

- Detailed Project Notes

- Notice of Bond Election – English

Notice of Bond Election – Spanish - Sample Ballot – Travis County

Sample Ballot – Williamson County - Notice of Voting Priority for Voters with Mobility Issues

Citizens’ Facility Advisory Committee (CFAC)

The Citizens’ Facility Advisory Committee (CFAC) will utilize the district’s long-range facility plan as we continue to manage growth across our 200-square miles. The committee was charged to develop a three- to five-year facility plan to meet the needs of this fast-growth school district. Facility considerations included advising the Board on the number of buildings needed, by when, and recommended ancillary space (such as athletic, science, arts, and other support spaces) including technology infrastructure.

CFAC Committee Resources

Resources for each include agendas, presentation and video links:

- Steering Committee Meeting Details

- Elementary School Subcommittee

- Middle School Subcommittee

- High School Subcommittee

- Security Subcommittee

- Information Technology Subcommittee

- Ancillary Subcommittee

Bond & CFAC Progress Updates

- Board Meeting Feb. 16, 2023: Board calls for May 2023 Bond

- Board Meeting Feb. 9, 2023: Vibrant discussion takes place as Board nears decision on calling bond election

- Board Meeting Feb. 7, 2023: Board takes three-pronged approach to the proposed bond election

- Board Meeting Jan. 26, 2023: CFAC Recommendations

- Jan. 16, 2023: CFAC Steering Committee Meeting

January 16 Video Recording - Board Meeting Jan. 12, 2023: CFAC presents update to Board

- Jan. 11, 2023: CFAC Steering Committee Meeting

January 11 Video Recording - Jan. 10, 2023: CFAC Steering Committee works through Subcommittee recommendations

January 10 Agenda | January 10 Video Recording - Jan. 5, 2023: CFAC Steering Committee works through Subcommittee recommendations

January 5 Agenda - Jan. 3, 2023: CFAC Subcommittees present recommendations to Steering Committee

January 3 Agenda | January 3 Video Recording - Nov. 16, 2022: CFAC Steering Committee Update

November 16 Agenda - Sept. 26, 2022: CFAC Steering & Subcommittees Kick-off Meeting

September 26 Agenda - Sept. 1, 2022: District asks for volunteers to join CFAC subcommittees

- Board Meeting July 21, 2022: Board approves CFAC Charter

Frequently Asked Questions

Did Leander ISD solicit the input of local citizens before developing the bond package?

Yes. As part of Leander ISD’s ongoing management of finances, facilities and long-range planning efforts, a Citizens’ Facilities Advisory Committee (CFAC) began meeting in September 2022 to recommend and develop a long-term capital program. CFAC’s goal was to make sure every student in every school has access to modern classrooms, quality academic programs, and educational tools and resources. After months of extensive work, the committee developed comprehensive bond recommendations to reflect the wishes of the Leander ISD community and its taxpayers and presented their report to the Board of Trustees for its consideration.

The Board wove together CFAC recommendations with the work of the Long-Range Planning Committee, aligning the bond package to the 10-year facilities plan.

Was every facility in the school district reviewed during the committee process?

Yes. With the goal of making sure we impact every student in every school, our Citizens’ Facility Advisory Committee’s steering committee and subcommittees considered the needs of every school and facility in the district.

How is this election different from the one voters approved in November 2022?

In November, voters approved allowing Leander ISD to make its required recapture payment to the state. Voters also approved additional revenue for maintenance and operations in order to fund pay increases for teachers and other staff.

The May 2023 election asks voters whether to approve the issuance of bonds for construction, facility renovations, safety and security projects, and other projects to be funded outside the budget for maintenance and operations.

How will the proposed bond impact my Leander ISD property tax rate?

The approval or defeat of any or all of the propositions on the May 2023 ballot will not impact the Leander ISD tax rate.

How is it possible that Bond 2023 would not result in a higher tax rate?

The district’s tax base continues to grow. In addition, the Board’s management of past debt has left the district with capacity for additional funding without a tax rate increase.

What are bonds? How long does it take to pay them off?

Just as homeowners borrow money in the form of a mortgage to finance the purchase of a home, a school district borrows money in the form of bonds to finance the construction of new schools and other capital projects. Both are repaid over time. A school district is required by law to seek approval from voters in the form of a bond election in order to issue bonds.

Under current Texas laws, the maximum maturity of a bond is 40 years. Assets financed by the bonds that have a shorter asset life are sold with shorter maturities that align with their useful life.

Why does the ballot language say “This is a property tax increase?”

A state law approved in 2019 requires all school bond elections in Texas to include that language, regardless of whether tax rates or tax payments are actually going up.

Can bond money be used to pay teachers more?

No. Bond funds can be used to pay for new buildings, additions and renovations to existing facilities, land acquisition, technology infrastructure, and equipment for new or existing buildings. By law, Bond funds cannot be used for district operating and maintenance expenses, such as teacher salaries, utility bills, and routine building maintenance.

Teachers must be paid from the Maintenance & Operations budget, which is funded by a different portion of the tax rate.

For a more detailed explanation of the tax rate, visit the district’s Smart Money: Finance 101 page.

Why are there three separate bond propositions?

Leander ISD is complying with changes made in 2019 to section 45.003 of the Texas Education Code. It requires school districts to divide bond elections into separate ballot propositions based on the projects being financed.

Why are bonds used to finance non-facility items?

The school finance formulas no longer provide the necessary funds that would allow the purchase of non-facility capital items through the General Operating Fund and still meet the ongoing day-to-day expenditures of educating students and running a large organization.

In addition, it is advantageous to the district to pay for capital items – such as technology, buses, land and portable buildings – with bond money rather than from the General Fund as the cost can be spread over the life of the asset rather than a single purchase diluting the General Operating Fund.

Once a bond is approved, is the district obligated to spend the money?

No. Voter approval of a bond election authorizes the district to issue bonds. However, bonds are sold in the future only when funds are needed for a particular project.

How do bond elections impact homeowners who are over 65?

School property taxes are frozen for homeowners who qualify for an exemption based on age (65 or older) or disability. Their taxes can go down, but not up. The bond propositions will not increase frozen levies.

What happens if the propositions are not approved?

If the bond propositions are not approved or specific propositions do not pass, LISD will consider alternative options for managing anticipated growth, including the possibility of utilizing portable buildings, implementing additional attendance rezoning, making operational budget cuts or reallocation, utilizing fund balance typically reserved for emergencies, and/or proposing future bond elections. We may also need to consider extending replacement cycles for equipment and technology devices.